Li Ka Shing Biography Ebook

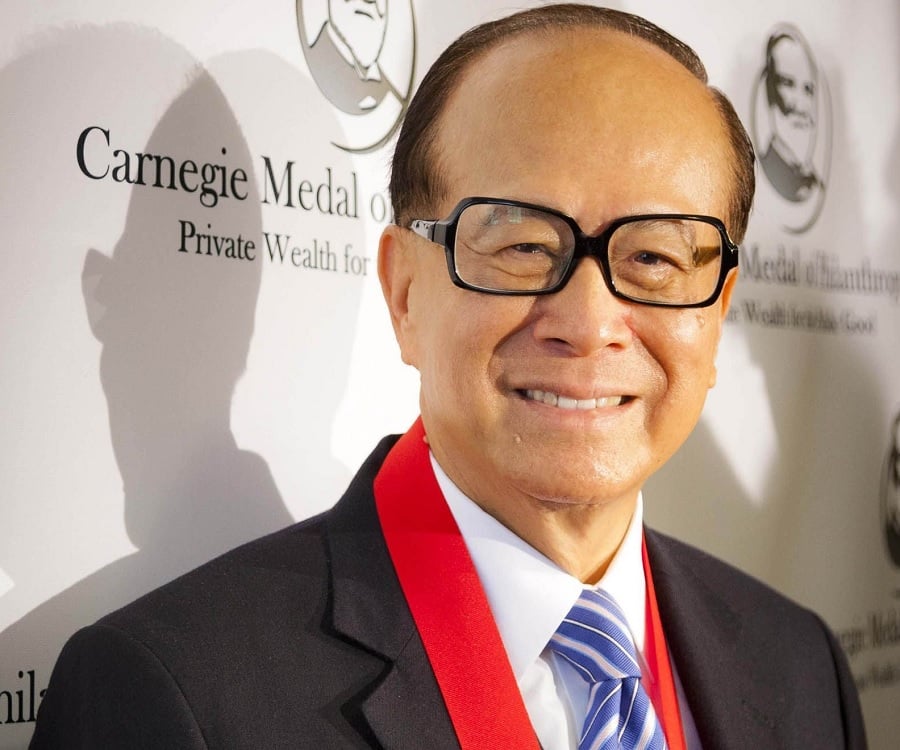

SynopsisAsian subcontinent gave the world some of its most prolific business leaders and entrepreneurs. However, very few make it to the zenith of success fighting poverty and a myriad of barriers. One such visionary and leader is Li Ka Shing.Without a strong financial background or adequate education, he managed to become one of the top business leaders in the world.With wealth amounting $ 31 billion, Li Ka-shing is the 11th Richest Person worldwide and Asia’s Richest Person. Through the Cheung Kong Group and Hutchison Whampoa Limited, he runs a business empire that is spread in 54 countries. The latter belongs in the league of Fortune Global 500 Company. His business has diversified into sectors like cement production, real estate, banking and steel production. Early LifeLi Ka Shing’s early years were spent in the Coastal city of Chiu Chow in China.

Li Ka-shing: Hong Kong's Elusive Billionaire Paperback – March 27, 1997. This is the biography of billionaire Li Ka-shing, the ultimate Hong Kong rags-to-riches success story. Chan is Director and Associate Professor at the Canadian Studies Centre, University of.

When he was a teenager, Li had fled to Hong Kong to evade war. After his father died of tuberculosis. Li dropped out of high school and found employment in a plastics trading company. When he was 22, Li began his own business of making plastic toys.

His first company was Cheung Kong. What started as a plastic manufacturing unit blossomed into a top real estate investment entity. In 1972, Cheung Kong Industries was listed in Hong Kong Stock Exchange. CareerWhile Cheung Kong Industries was growing exponentially, in 1979 Li acquired Hutchison Whampoa Limited after a deal with HSBC. It led to the creation of a massive conglomerate with business spreading into various sectors. Later, he focused on investing in top container port facilities in many countries.Under Li’s leadership and supervision, Hutchison Whampoa Limited ventured into several sectors including retail, asset treading and telecommunications. Hutchison Telecommunications sold majority of its controlling stake in Hutchison Essar in India to the Vodafone group.Li also made a foray into the fast growing technology and internet business.

- Tag: li ka-shing Media Confirmation: “Jeff Bezos announces divorce from MacKenzie Bezos after 25 years together” January 9, 2018 – as predicted by Clairvoyant Dimitrinka Staikova in her Ebook and Paperback book published in Amazon April 23, 2016: Billionaires – Mysterious, Hidden, Scandalous,Personal life – girlfriends and marriage, Heirs,Business, Money and World Power.

- Li Ka-shing: The Honourable Sir Li Ka-shing. World Heritage Encyclopedia, the aggregation of the largest online encyclopedias available, and the most.

Li Ka Shing Foundation bought stake in Facebook with a $120 million deal. He also invested in Spotify, a popular online music streaming service.Despite being the Largest and Richest Entrepreneur in Asian sub content, Li finds time to focus on philanthropic activities.

In 1981, he set up Shantou University. He also donated to the Hong Kong Polytechnic University in 2001 post which a tower was named after him.He sold his stake worth $1.2 billion CAD in CIBC in 2005 and the proceeds went to Li Ka Shing Foundation.Li’s success is not just the proverbial rags to riches story but also a lesson in determination and humility.

Contents.Business career A article summarises Li's career in the following way:From his humble beginnings in China as a teacher's son, a refugee, and later as a salesman, Li provides a lesson in integrity and adaptability. Through hard work, and a reputation for remaining true to his internal moral compass, he was able to build a business empire that includes: banking, construction, real estate, plastics, cellular phones, satellite television, cement production, retail outlets (pharmacies and supermarkets), hotels, domestic transportation (sky train), airports, electric power, steel production, ports, and shipping. Plastics manufacturing In 1950, after learning how to operate a plant, Li founded a plastic manufacturing company in Hong Kong with personal savings and funds borrowed from relatives. Li avidly read trade publications and business news before deciding to supply the world with high quality at low prices. Li learned the technique of mixing colour with plastics that resemble real flowers.

After retooling his shop and hiring the best technicians he could find, he prepared the plant for a visit from a large foreign buyer. Impressed with the quality of Li's plant, the buyer placed a large order. A few years later, Li grew to be the largest supplier of plastic flowers in Asia and made a fortune selling them. Real estate In 1958, believing rents would continue to rise, Li decided to purchase a site and develop his own factory building.

An opportunity to acquire more land arrived after the when many people fled Hong Kong, and, as a result, property prices plummeted. Li believed the political crisis would be temporary and property prices would eventually rise, and bought land from the fleeing residents at low prices. In 1971, Li officially named his real estate development company (長江實業). Was publicly listed in in 1972.

During board meetings, Li stated on a number of occasions his goal of surpassing the Jardines-owned as a leading developer.The successful bid by for development sites above the Central and Admiralty MTR stations in 1977 was the key to challenging Hongkong Land as the premier property developer in Hong Kong. Despite its size, Jardines decided in the 1980s to protect itself from hostile takeover by Li or other outside investors. The company implemented a cross-shareholding structure that was designed to place control in the hands of Britain's Keswick family despite their less than 10% holdings in the group. In 1984, the company also moved its legal domicile from Hong Kong to another –, in anticipation of the transfer of sovereignty of Hong Kong to People's Republic of China in 1997.In an effort to drive forward divestitures of assets in Hong Kong and the Chinese Mainland, Li agreed to sell, the fifth-tallest skyscraper in Hong Kong.

With a volume of HK$40.2 billion (US$5.15 billion), the deal constitutes the biggest ever office space real estate sale in the Asia-Pacific region. Li sold the Century Link complex in for US$2.95 billion, the second largest transaction for a single building, according to the.In 1979, with help from, Li controlled the, which increased control to 12% of the world container port facilities, especially in, the, and many. Retail A subsidiary of CK Hutchison, the (ASW), is a retail operator with over 12,000 stores. Its portfolio encompasses retail brands in Europe such as (UK), Marionnaud (France), (Benelux countries), and in Asia including health and beauty retailer store and wine cellars et al., PARKnSHOP supermarkets (and spin-off brands), and Fortress electrical appliance stores. ASW also produces and distributes water products and beverages in the region.Asset trading group has the reputation of being an astute asset trader. It builds up new businesses and sells them off when shareholder value could be created.

Huge profits were obtained in the sale of its interest in to Mannesmann Group in 1999, making a profit of $15.12 billion. In 2006 Li sold 20% of Hutchison's ports business to Singapore rival PSA Corp., making a $3.12 billion profit on a $4 billion deal.Group subsidiary sold a controlling stake of 67% in, a joint venture Mobile operator in India, to for $11.1 billion. It had invested roughly $2 billion earlier. Internet and technology Li has also made a foray into the technology business, where his investment and venture capital firm is specifically allocated towards backing new internet and technology startup firms, and bought a stake in.

His other firm, the bought a 0.8% stake in social networking website for $120 million in two separate rounds, and invested an estimated $50 million in the music streaming service. Some time between late 2009 and early 2010, Li Ka-shing led a $15.5 million Series B round of financing forIn 2011, Horizons Ventures invested in, a website-summarizing app.

Notably, the investment made Nick D'Aloisio, Summly's founder, the world's youngest person to receive a venture capital investment at just fifteen years old. In 2012, Horizons Ventures invested $2.3 million in Wibbitz, a company that provides a text-to-video technology that can automatically convert any article post or feed on the web into a video in a matter of seconds. In August 2012, Li acquired a stake in Ginger Software Incorporated. In 2013, Horizons Ventures invested in payment company BitPay.In February 2015, Horizons Ventures participated in a $30 million Series C funding round in Zoom Video Communications. Later in the year, Li participated in a $108 million Series D round in Impossible Foods. In 2016, he continued investments in technology companies and Horizons Ventures led a $55 million Series A round in, the leader in blockchain related technologies, and also invested in a startup incubator fund Expa, that works with the founders to build new companies. Australian tax dispute In 2013 a claim was lodged by the (ATO) against (CKI) to pay approximately A$370 million in unpaid tax, penalties and interest relating to tax disputes concerning and Victoria Power Networks.

The dispute was resolved in 2015 when CKI entered into an agreement with the ATO. No penalty was levied against CKI and a sum of approximately A$24 million was refunded from the A$64 million previously paid to the ATO by CKI. Retirement After his almost-70-year-long reign over and, Li announced his retirement on 16 March 2018 and the decision to pass his $100billion empire on to his son,. Yet, he would still be involved in the conglomerate as a senior advisor. Others Besides business through his flagship companies and, Li Ka-shing has also personally invested extensively in real estate in Singapore and Canada.

He was the single largest shareholder of (CIBC), the fifth largest bank in Canada, until the sale of his share in 2005 (with all proceedings donated, see below). He is also the majority shareholder of a major energy company, based in, Canada.In January 2005, Li announced plans to sell his $1.2 billion stake in the, with all proceeds going to private charitable foundations established by Li, including the in Hong Kong and the Li Ka Shing (Canada) Foundation based in, Ontario. Li was the non-executive director of since 1980 and became Deputy Chairman of the bank in 1985.

He was also Deputy Chairman of in 1991–1992.Personal life His two sons, and, are also prominent figures in the Hong Kong business scene. Victor Li works directly with his father as Co-Managing Director and Deputy Chairman of, while Richard Li is the head of, the largest telecom company in Hong Kong. They are both Canadian citizens. He has a granddaughter Michelle Sarah Li Se De, who studied at the Chinese International School in Hong Kong.Li is famously plainly dressed for a Hong Kong tycoon.

Li Ka Shing Biography

In the 1990s he wore a $50 HKD timepiece from and plain ties. He later wore a. In 2016, he wore a $500 HKD Citizen watch.His son Victor Li was kidnapped in 1996 on his way home after work by gangster. Li Ka-shing paid a ransom of HK$1 billion, directly to Cheung who had come to his house. A report was never filed with Hong Kong police. Instead the case was pursued by authorities, leading to Cheung's execution in 1998, an outcome not possible under Hong Kong law. Rumours circulated of a deal between Li and the Mainland.

In interviews, when this rumor was brought up, Li brushed it off and dismissed it completely.Awards and honours.Politics On 4 August 2011 at the interim results announcement for, Li endorsed for the. Then Li said 'You all can be just like me, one-person-one-vote (一人一票).' The media then looked at Li in disbelief, and pointed out that regular citizens do not get one-person-one-vote. Li then tried to laugh it off and said 'maybe in 2017 they will have one-person-one-vote to choose the chief executive, I probably just said it a little early.'

Li was, however, criticised by Xinhua for not being unambiguous in his opposition to the and his support for. Later, prior to the Legco vote, Li said that the largest threat to Hong Kong's future was if the government failed to ensure passage of the.Li's business empire has presence around the world, including China. Li came under attack from Global Times in early 2015, when his companies put out word that it was considering selling prime Shanghai and Beijing properties. It became apparent that Li aimed at re-weighting his asset portfolio to more stable and transparent markets in the West. Concerted attacks ensued and went into a crescendo as China's economy slowed down dramatically in the second half of the year, and the central government sought a way to stem the capital outflows. Specific reproaches were that his asset disposals were 'an act of ingratitude' and 'immoral at such a sensitive juncture'.

Richard Li Tzar Kai

Security Times, a People's Daily publication, estimated that Li has sold at least 73.8 billion yuan worth of assets since 2014. Li's holding companies denied divesting in China, saying that its asset disposals were being undertaken in the ordinary course of business.

The attacks stopped abruptly several weeks later, when editorials in official publications such as People's Daily, Beijing Youth Daily took a neutral stance in unison. Charities. Li Ka Shing Tower of the Hong Kong Polytechnic University. Li's donation in 1981 resulted in the founding of (STU) and the Shantou University Medical College, near his hometown of.

Li has earmarked grants of HK$8 billion through 2018 to develop STU. In 2013, Li granted US $130 million to establish the in Guangdong Province as a joint venture between and.

In September 2001, the newest tower in the was named after Li, following a HK$100 million donation to the University. The Li Ka Shing Centre in, England, houses a facility, which is a part of the University of Cambridge. The Centre was named after Mr.

Li following a £5.3 million donation, and was opened in his presence in May 2002. The Li Ka Shing Foundation endowed a professorship of at the university in 2007 with a subsequent gift of £2 million. In November 2002, the Cheung Kong Graduate School of Business in China was founded with a large donation from the Li Ka Shing Foundation. The Li Ka Shing Library at the is also named in his honour after a US$11.5 million donation in 2002 to the higher education institution. After the disaster, Li reportedly pledged a total of US$3 million.

In 2005, Li announced a HK$1 billion (US$128 million) donation to the Faculty of Medicine,. It was renamed to on 1 January 2006, which provoked controversy between the university and quite a number of alumni of the faculty, notably, over the university's naming procedures.

Also in 2005, Li donated US$40 million to the, citing that he was impressed with the university's accomplishments in the biosciences. In recognition of Li's donation, the university has named the campus' new biosciences facility the Li Ka Shing Center for Biomedical and Health Sciences, which opened in October 2011. In 2014, The Li Ka Shing Foundation provided a US$10 million gift to support and to jointly launch the Innovative Genomics Initiative (IGI), based on a new technology discovered at by Professor, executive director of the initiative. In the same year, the Li Ka Shing Foundation has also provided $3 million to for exploring new ways of utilising biomedical data to improve human health. A long-time supporter of since the 1980s, Li is the principal benefactor to the US$90 million Li Ka-shing Center for Learning and Knowledge, which opened in Fall 2010 and is now the headquarters for the. On 9 March 2007, Li Ka-shing contributed SGD$100 million to the Lee Kuan Yew School of Public Policy in the. Also, 'to honour and recognize Dr.